Extra! Extra! Read all about it! Lee Enterprises is for sale!

Merger arbritage opportunity with potential 50-70% return and an extremely near term catalyst

After acquiring ~10% of Lee Enterprises (“Lee” or the “Company”) within the last year, billionaire investor David Hoffmann (“Hoffmann”) publicly shared a letter expressing interest in acquiring Lee outright.

In response, Lee amended their soon to be expiring poison pill by extending it’s maturity to 3/2026. Within that same disclosure, Lee offered to enter into a confidentialty agreement to allow Hoffmann to make a bid.

Hoffmann first invested in Lee in 10/2024, and made his interest very clear from the start. He wants to buy the Company and add it to his growing media empire, Hoffmann Media Group. It felt like every other week Hoffmann was announcing increased ownership (initial press release, then here, here, here… and here) or talking up his interest in local news (here and here). Frankly, it got a little annoying.

We believe that Hoffmann and Lee subsequently entered into a confidentialty agreement and are actively negotiating sale terms, which could be announced prior to Lee’s 2Q2025 earnings release in 5/2025.

What might that offer look like? Well we know the following:

Hoffmann was buying in size at $16-18 per share (here and here) as recently as 12/2024.

On 3/27/2025, Sidoti & Company put out an updated note on their coverage of Lee, which indicated that Hoffmann’s pursuit was positive for their investment thesis. Sidoti assigned a price target of $20. We typically place very little weight on what sell side analysts say… but Sidoti’s coverage is company sponsored… meaning Lee is paying Sidoti to cover them and put out these notes! If Sidoti is saying this is a positive development, it is likely that Lee’s management tacitly implied the same in conversations with Sidoti! We think this is Lee’s “ask” price going into negotiations.

Quint Digital, an Indian media company which owns ~12% of Lee has been buying in the $12-15 range as of March 2024 (here, here, here and here). Quint has similarly expressed an interest in acquiring the Company outright. In response to the 3/2024 share acquisitons, Lee adopted a poison pill. Had they not, it is likely Quint would have continued to acquire shares. We believe this provides some price floor to the negotiations.

The recent extension of the poison pill limits Hoffmann’s ability to acquire shares in open market purchases at the current depressed prices. This forces him to have to pay up to acquire the remaining shares.

In 9/2024, Hoffmann Media Group acquired The Napa Valley Publishing Company from Lee, so the two parties do have a working relationship and have transacted before. This is important.

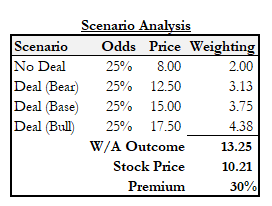

Given the aformentioned as well as the weak 1Q2025 earnings (discussed later in this writeup), we believe there is a 75% chance an offer materializes within the $12.50-$17.50 per share range. Accordingly, we estimate a 25% chance negotiations breakdown, where the stock will likely return to $8 per share. This reflects a weighted average outcome of $13.25 per share, a 30% premium to the stock price. Should a deal materialize, we think it would be announced prior to 2Q2025 earnings in 5/2025.

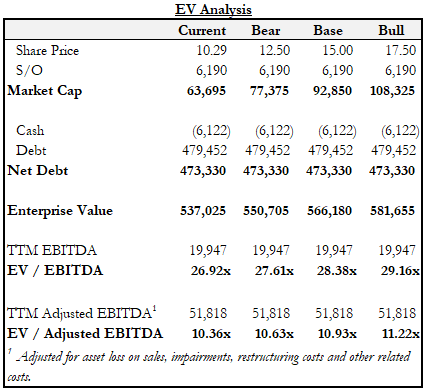

It should be highlighted that the above range in sales price has little impact on the enterprise value due the size of debt within the stack. If it doesn’t make much of a difference to the resulting valuation, why wouldn’t Hoffmann just pay up to seal the deal?

Management and the board will be under pressure to agree to a deal after bungling a potential sale in 2021, when Alden Global Capital made a bid for Lee at $24 per share. The offer was rejected after shareholders Cannell Capital Management and Praetorian Capital Management put out rebuttals (here and here). Alden continued to pursue Lee until it eventually backed off the following year.

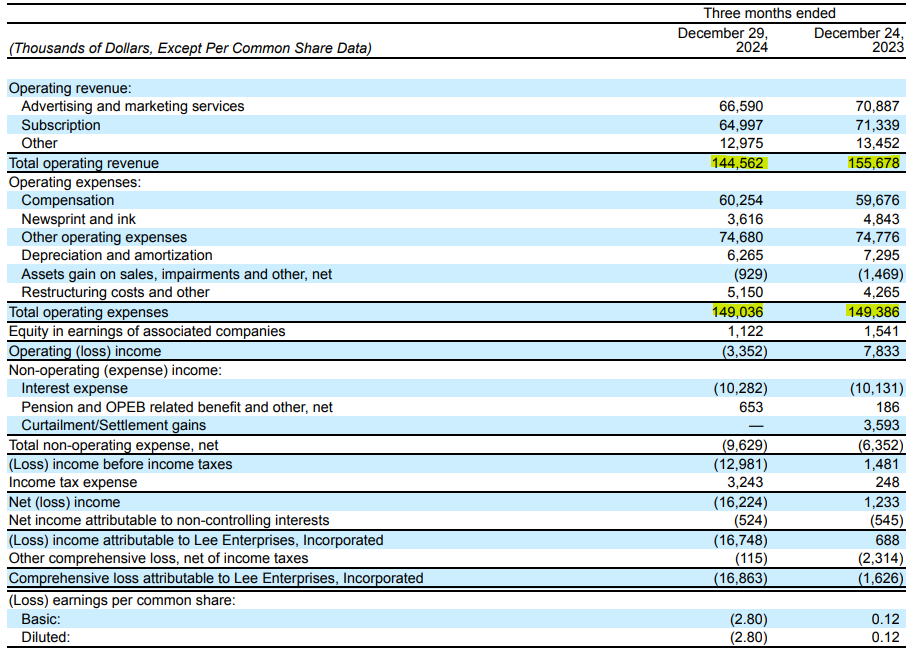

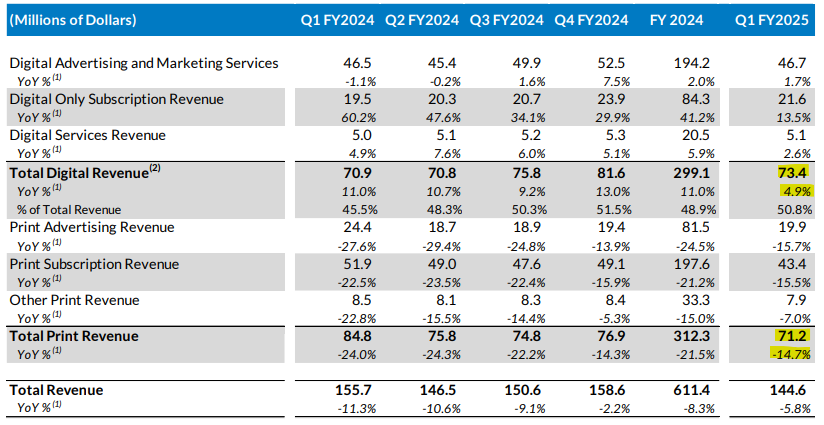

Since then, digital growth has fizzled while print declines have continued. The underperformance continued into 1Q2025, which was a substantial miss on the top and bottom line (EPS missing by $2.40 and revenue by $6M). The quarter further reflected revenue declines well in excess of expense cuts. It is clear that management’s strategy is not playing out as they expected nor guided to. Even Hoffmann was shocked at the quarter in this recent article.

In the 1Q2025 earnings release, management stated they had identified ~$40M in annualized cost reduction that should be executed by end of 2Q2025. However, given the lackluster digital revenue growth as well as the accelerated decline of print revenue, the Company will likely continue to be in a difficult position.

Furthermore, in 2/2025 Lee announced that they had experienced a cybersecurity attack and that “the Incident is likely to have a material impact on the Company’s financial condition and results of operations”. The attack was so significant that Lee had to negotiate an interest waiver with its lender. Lender’s do not typically waive interest unless their is a material concern.

Between the weak performance in 1Q2025 as well as an impacted 2Q2025, the Company is running out of time. Tick-tock.

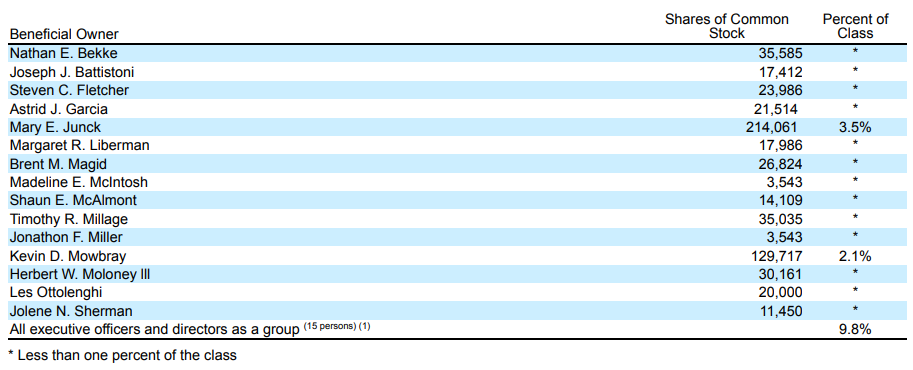

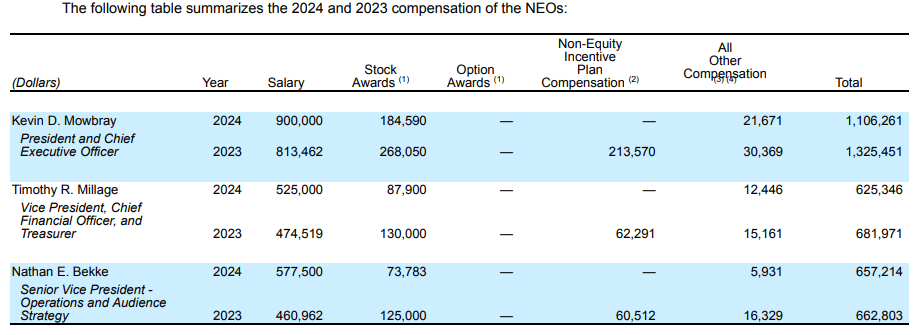

The Proxy Report filed in 1/2025 provides some insight on incentives that may influence the decision to sell. Insiders own ~10% of the Company.

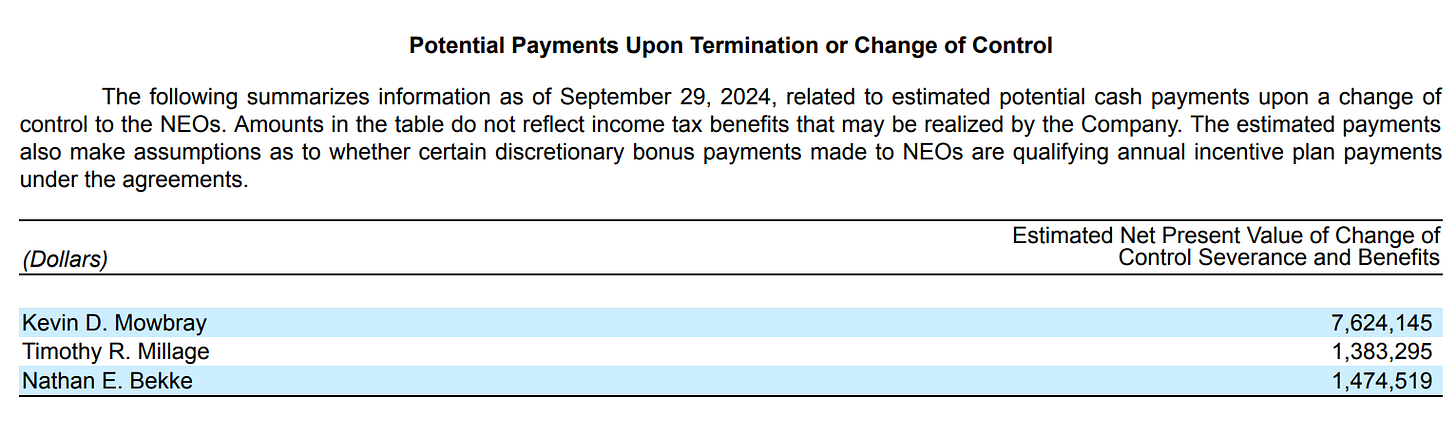

More importantly, the Proxy outlines certain Change of Control provisions, providing $7.6M in severance to CEO Kevin Mowbray alone.

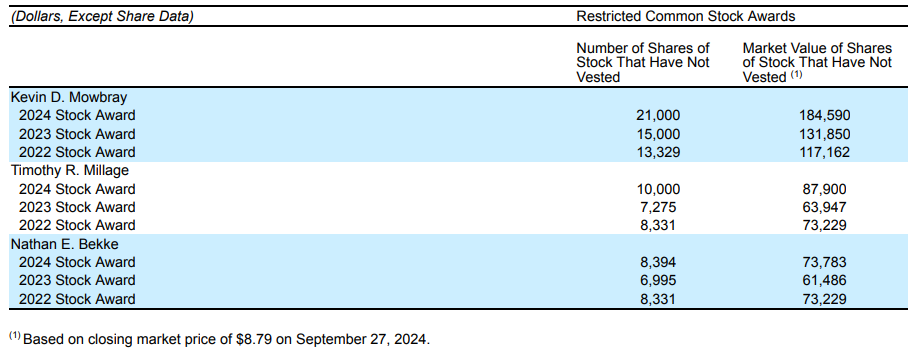

While not particulary significant, stock option awards do become fully vested and exercisable upon a change of control.

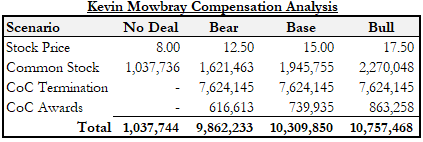

All told, CEO Kevin Mowbray, who is 63… cough cough, stands to benefit to the tune of $9.9-10.8M in cash if Lee is acquired vs $1M in a no deal scenario.

His annual compensation is currently ~$1.1M/year. At the rate things are going for Lee, who knows how long that can continue for.

What would you do?

Disclaimer

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer's securities.

This is not investment advice. Please do your own research.

Thanks, great insights as always! Are you still in $DALN by the way or sold out after the Q4 results analysis? I’ve added a bit more at these recent prices. Still think we get a $3.50 dividend, announced in 3 weeks time.