New England Realty Associates Limited Partnership ($NEN)

Boston real estate investor trading at a 50% discount to fair value with substantial tailwinds for growth

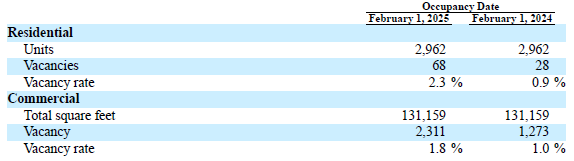

New England Realty Associates Limited Partnership (“NEN” or the “Company”) owns and manages 31 properties which include 22 residential buildings and properties; 5 mixed use residential, retail and office properties; 4 commercial properties, and individual units at one condominium complex. These properties total 3,015 apartment units (including 72 under construction), 19 condominium units and approximately 131,000 square feet of commercial space. Additionally, the Company also owns a 40-50% interest in 7 residential and mixed use properties consisting of 688 apartment units, 12,500 square feet of commercial space and a 50 car parking lot. The properties are primarily Class-B buildings located in Greater Boston.

Unlike most real estate investment companies, NEN is not a Real Estate Investment Trust. It is structured as a Master Limited Partnership. The taxable implications of this structure are important to understand.

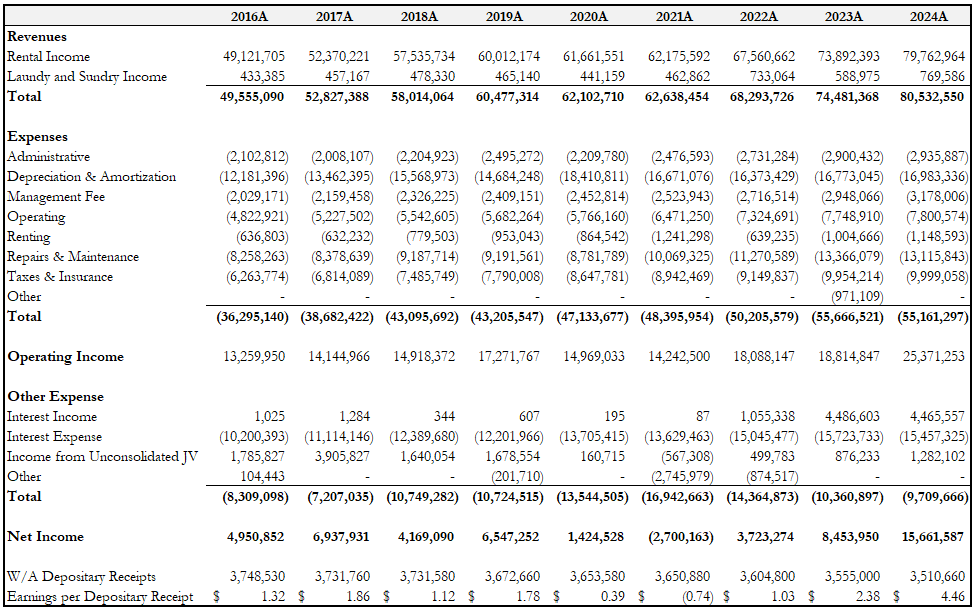

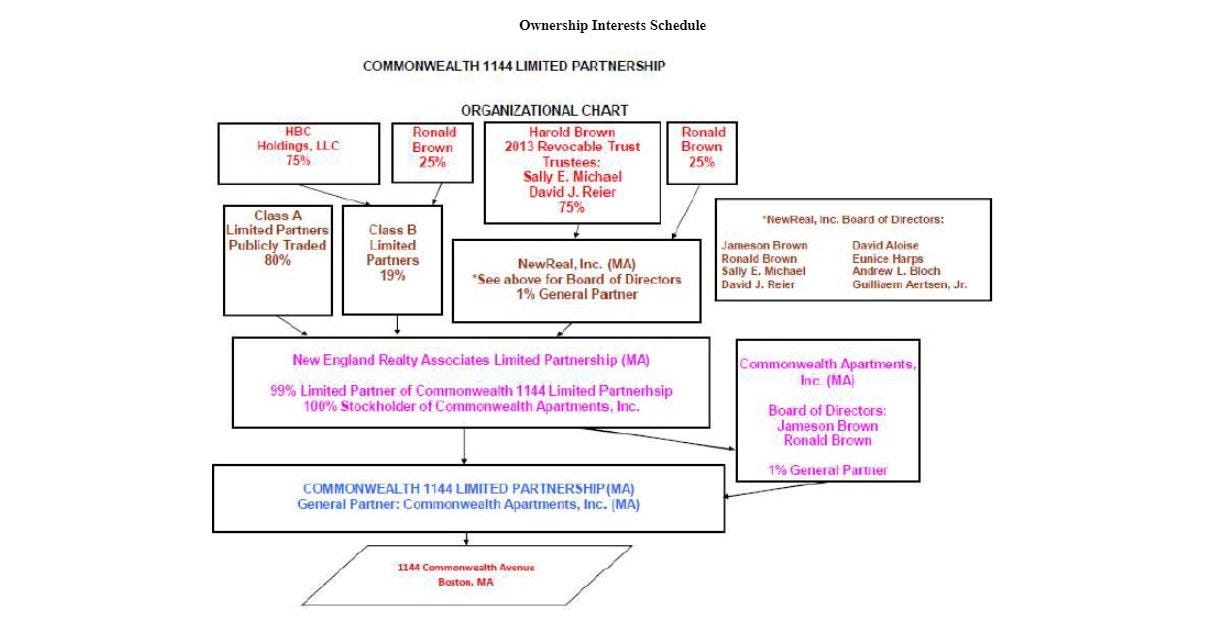

The Company is majority owned and led by the Brown family, who have proven to be conservative and savvy operators. Outside of the COVID-19 impacted years of 2020 and 2021, operating income has grown every year. NEN has a somewhat complex ownership structure with Class A, Class B, and GP shares as shown in the schedule below. The structure provides the Brown family with complete control over the Company.

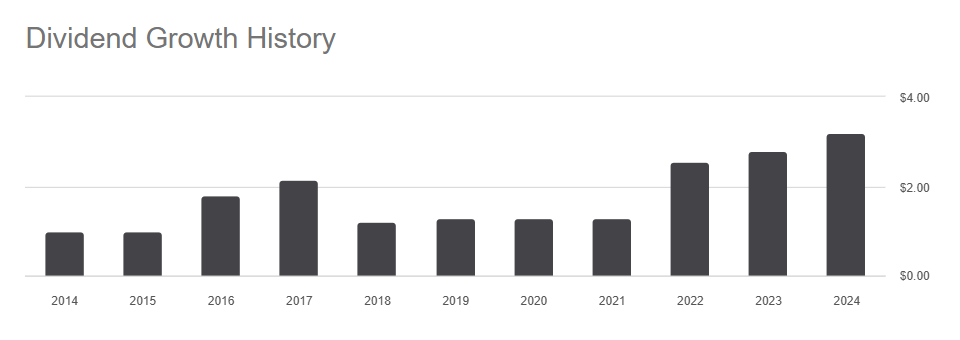

Due to NEN’s strong historical cashflows as well as the limited opportunities to deploy cash, the Company has built up a sizeable liquidity (cash, cash equivalents, and t-bills) cushion in excess of $100M. While cash has built up on the balance sheet, the dividend continues to increase (currently 6% dividend yield) and repurchase shares (limited by low trading volume).

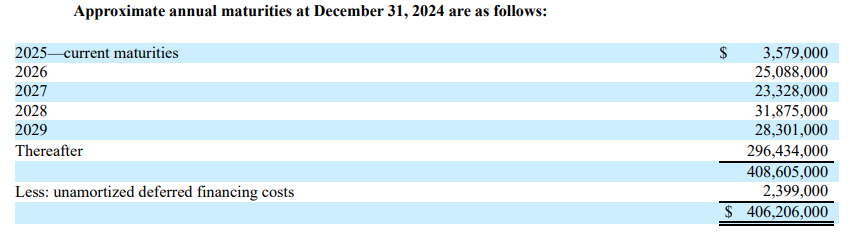

Management took advantage of the rate environment during 2021-2022 and refinanced a substantial portion of the outstanding debt at ultra-low rates (e.g. in 2021 NEN refinanced $156M in debt at 2.97% through 2031).

Given the concerns around real estate and the economy in general in 2025, we like that the Company has substantial liqudity resources in addition to a conservatively leveraged balance sheet.

As example of what NEN owns is 62 Boylston Street, a 268-unit pre-war era building in Downtown Boston.

While somewhat dated, the properties are generally very well maintained.

The Company has historically operated with very low occupancy rates.

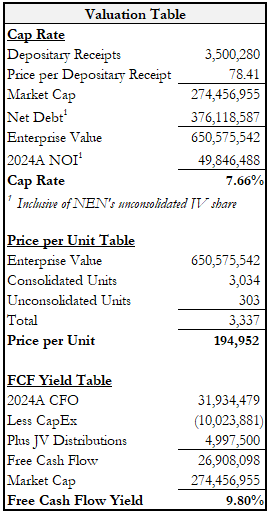

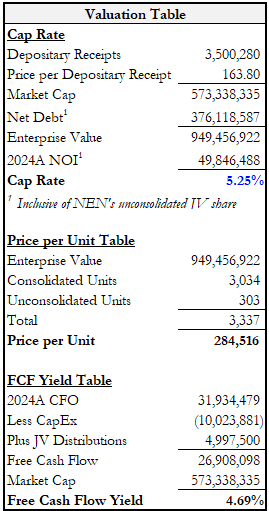

NEN is currently trading at a 7.7% cap rate, $195K price per unit (excludes non-multifamily properties), and a 10% FCF yield.

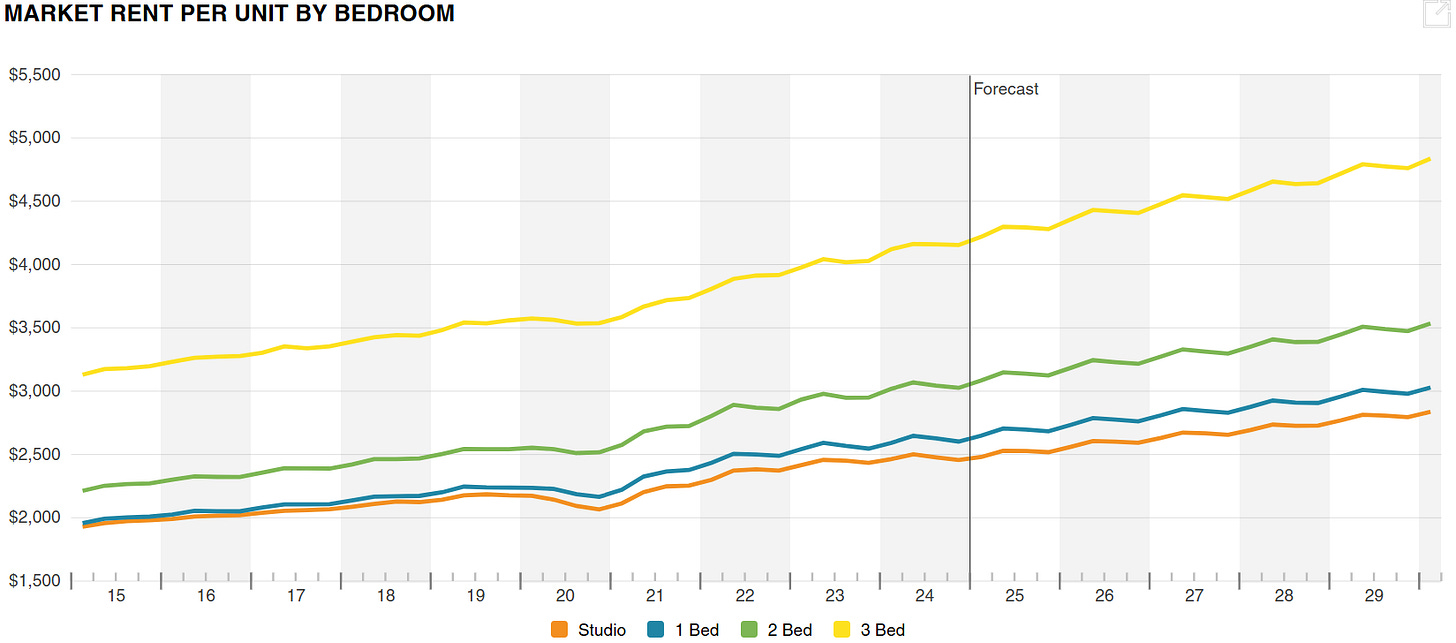

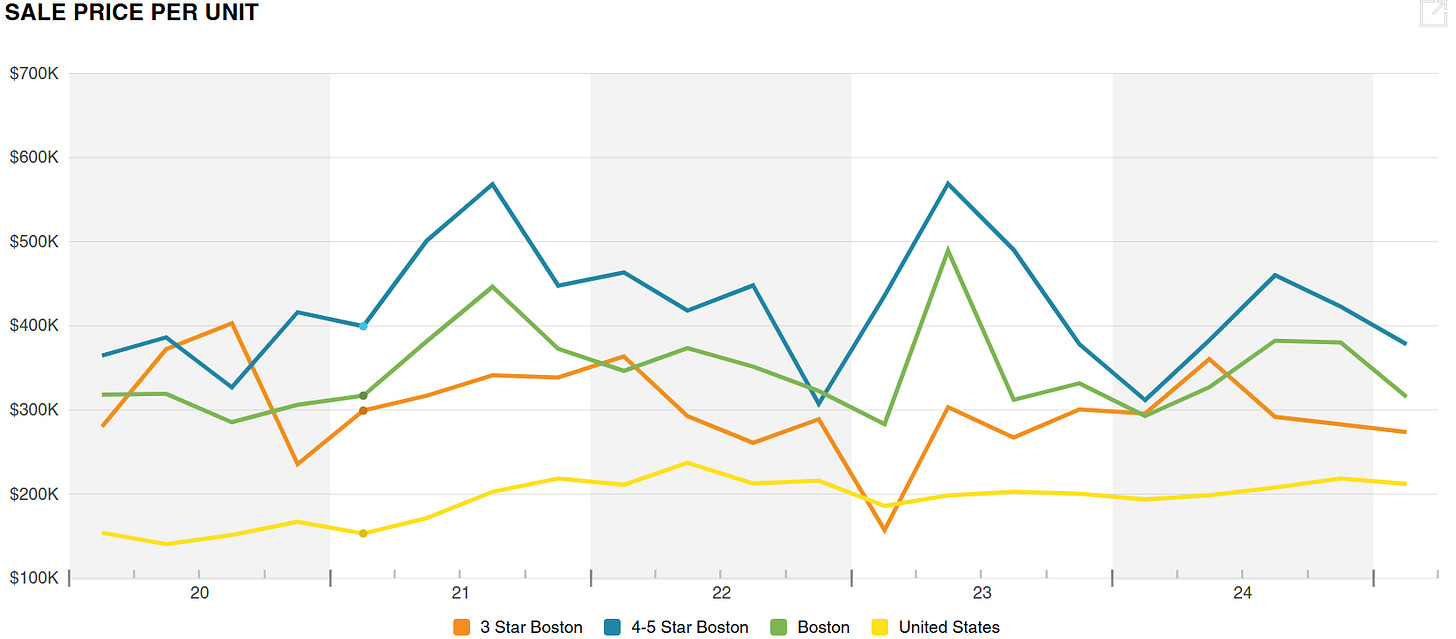

The valuation makes no sense given Boston is one of the most supply restricted markets in the country (i.e. there is simply not enough supply of housing to satsify demand). As can be seen in the chart below, rent growth has moved steadily up nearly ever year.

While we caution reliance on any forward looking data, this rent growth is likely to continue as the new development pipeline dries up. CoStar noted “Boston's apartment supply growth has started to soften, with 7,300 units delivered in 2024 compared to the 8,300 10-year average. Developers are responding to high interest rates and rising building costs by reducing construction starts. With greater uncertainty in the labor and materials markets in the near term, the pipeline looks to narrow and remain relatively subdued over the next few years.” and “Currently at 2.1%, year-over-year asking rent growth works to regain the long-term average of 3% for the Boston metro. This local growth outpaces the national figure, which is now a mere 1.2%. It is also good enough to rank near the top among the country's top 25 multifamily markets by unit count, another sign of Boston's resilience. Local rents are expected to accelerate through late 2025 as the supply pipeline exhaustion helps tighten the market.”

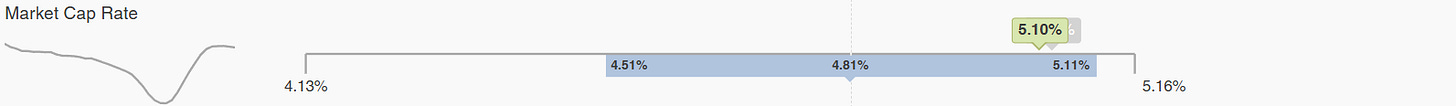

CoStar data reflects market cap rates for comparable properties of just over 5%.

Comparable sale price per unit generally range from $300-375K per unit.

For valuation purposes, we assume a 5.25% cap rate across the portfolio, reflecting an estimated price per depositary receipt of $163.80, an upside of over 100% compared to todays price of $78.41. This valuation utilizes a cap rate in excess of where the market trades for comparable properties and results in a per per unit well below what comparable sales reflect. Additionally, this valuation fully excludes all non-multifamily properties for simplicity's sake.

While there might always be a discount given the MLP tax treatment as well as the multi-class share structure, we feel the size of the current discount is unwarranted. Additionally, NEN stands to benefit from tailwinds as the supply of new developments slow and rent growth picks up.

Disclaimer

I do not hold a position with the issuer such as employment, directorship, or consultancy

I and/or others I advise hold a material investment in the issuer's securities.

This is not investment advice. Please do your own research.