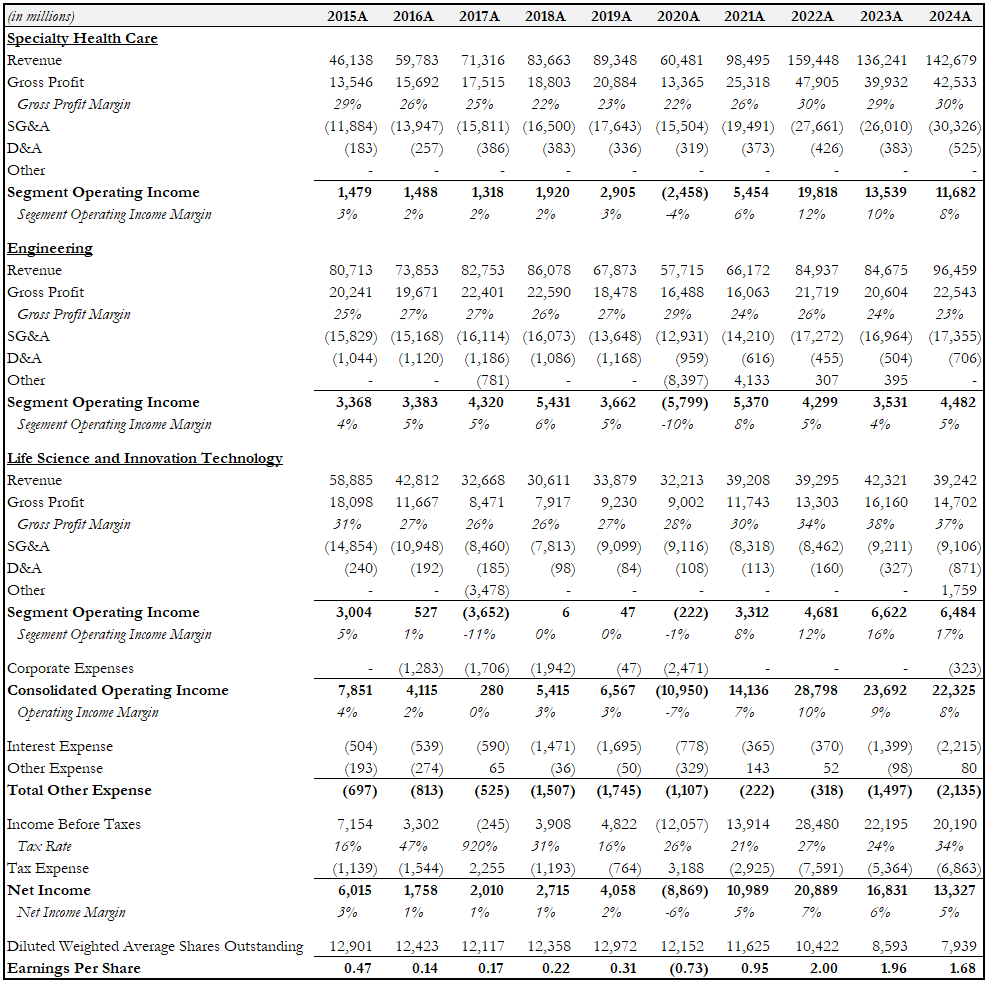

RCM Technologies (“RCMT” or the “Company”) is a provider of business services across three segments: Specialty Health Care, Engineering, and Life Sciences and Innovation Technology.

Specialty Health Care provides staffing solutions of health care professionals, primarily health information management professionals, nurses, paraprofessionals, physicians and various therapists.

Engineering provides a comprehensive portfolio of engineering and design services across three verticals: (1) Energy Services, (2) Process & Industrial and (3) Aerospace.

Life Science and Innovation Technology provides enterprise business solutions, application services, infrastructure solutions, life sciences solutions and other vertical-specific offerings.

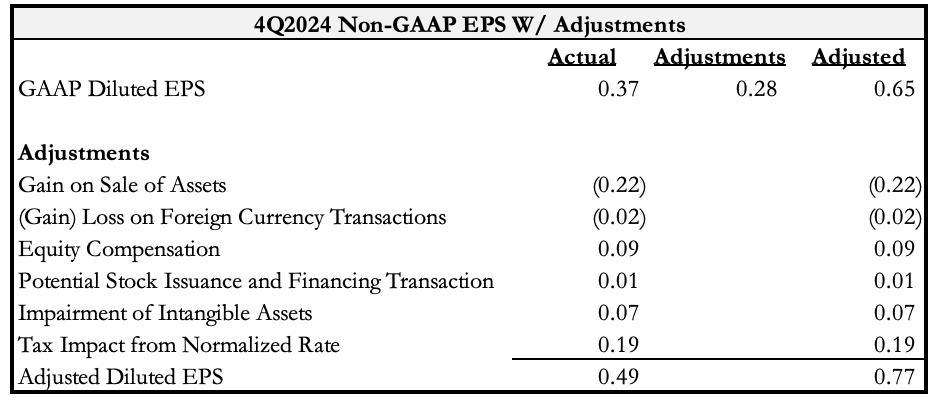

In 3/2025, RCMT reported 4Q2024 Non-GAAP EPS of $0.49, a significant miss from consensus estimate of $0.83. Between the earnings miss and market uncertainty around potential negative impacts from the Trump Administration’s DOGE, the stock sold off in 1Q2025.

Approximately $0.28 of the EPS miss was related to one-time items and were detailed in the subsequent 4Q2024 earnings call.

$900K reduction in gross profit related to “In our Engineering group, a significant industrial process equipment order was abruptly canceled midway through the project. Also, our Technical Publications group experienced significant rework on a large project with one of our aerospace clients. These two items caused an approximate $900,000 reduction in gross profit in Q4.”

$1.25M higher than expected SG&A related to “… our self-insured medical plan had abnormally high medical costs that increased SG&A expenses by about $1.25 million from what we would normally expect.”

In the same 4Q2024 earnings call, management was asked about potential impact from DOGE:

CFO Kevin Miller said “No direct nothing direct. I mean I think DOGE can potentially have some impact on the IT environment in general, not talking about RCM. I mean we don't do -- most of our work for government is working as a subcontractor, and most of that work is in the aerospace industry. And we don't, as of today, we don't expect any major impact. Certainly, if a lot of IT workers are getting laid off because of DOGE, that can impact the IT environment in general. But like we don't see any direct link as of today to any major impact on RCM”

CEO Brad Vizi said “…I'd just echo Kevin's sentiments. The other thing I see playing out, right, we seem to generally be insulated from, when you start to think about the services business, and particularly ours, so the times where you do have blips and material reductions in workforce, inevitably, they overshoot, right? And so the first one has actually come back onto the contractors like us. So as I see all this playing out just like you do, and we are, again, managing the business every single day to continue to move the ball on the field, and we're not really seeing an impact. The more I see this play out, the more I think to myself, at some point, these reductions in workforce, when are we going to be on the right end of overshooting, right? So in other words, like these government reductions, you are bringing people back, right? Those people that you just let go, oftentimes, they are -- they're dispersed into the broader economy and they find different jobs, and you have a gap fill pretty quickly. So it's too early and there's too much uncertainty with respect to me to pound the table either way. But it hasn't been an impact today, and we're optimistic that, at some point, it may actually be a tailwind.”

Additionally in the call, management provided their own expectations around the business for 2025:

CFO Kevin Miller in responding to a question on whether double digital earnings growth was acheivable going forward “…we strive to grow our adjusted EBITDA quarter-over-quarter every quarter in the low double digits. That's our goal, okay, is to grow at least in the low double digits. And we don't see any reason why we can't accomplish that in 2025. I mean Q4 2025 is sort of a long ways away.” and “…our expectation as a company is to grow adjusted EBITDA low double digits every quarter. And if we don't, then it's a failed quarter, frankly. And that's how we ring it up on the scorecard. If we don't hit those numbers, then it's a failed quarter. So as we look out at 2025, we're optimistic. And we don't see any reason why we can't hit our goals.”

While 4Q2024 was a 8% EPS miss on an adjusted basis (adjusted EPS $0.77 / consensus EPS $0.83), we believe the extreme selloff was unwarranted.

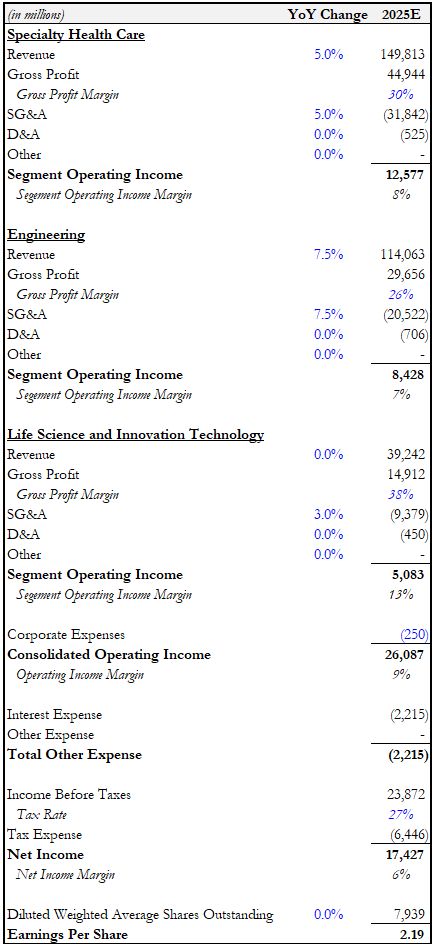

Our expectation is for the stock to generate GAAP EPS of ~$2.19 in 2025 (not adjusted for share buybacks), implying a ~7x P/E and a ~14% earnings yield. Assumptions include minimal growth.

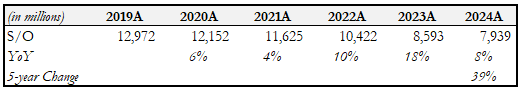

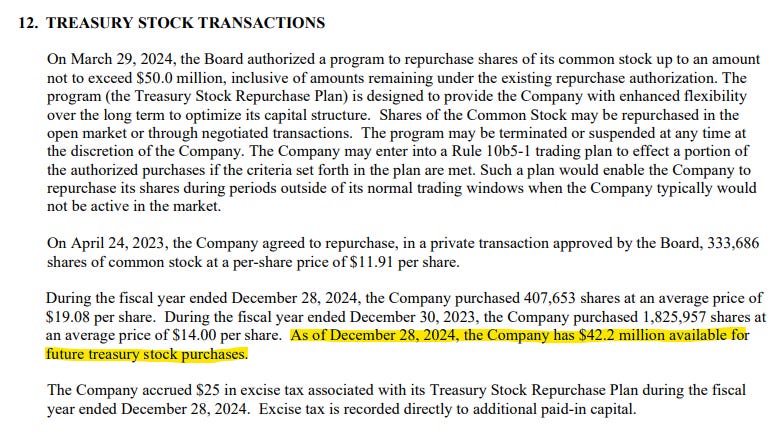

The business does not pay a dividend and capital expenditures are minimal (in line with depreciation and amortization). As a result, management have utilized excess cash flows to repurchase stock. Over the last 5-years, the Company has retired 39% of shares. In 2024, managemnet repurchased ~400K shares at an average price price of $19.08 per share. The stock is ~$15 today.

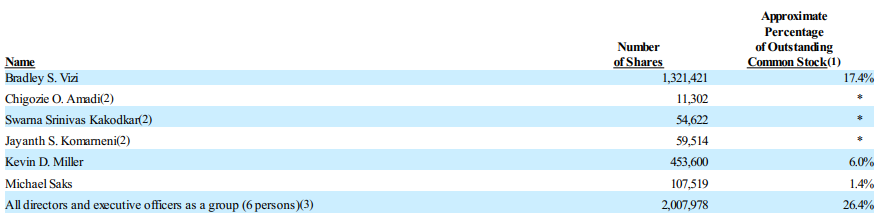

Under the current plan, the Company is authorized to repurchase $42M in shares. Brad Vizi (CEO) and Kevin Miller (CFO) own a combined ~23% of oustanding shares.

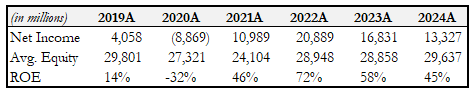

In addition to being incentivized to increase the share price (and buyback stock), management has proven to be savvy capital allocators with the business generating double digit ROE figures every year over the last 6 years (outside of the aberration that was 2020).

Given the unchanged business profile as well as the depressed stock price, we anticipate a substantial portion of cash will go towards repurchasing stock in 2025.

Disclaimer

I do not hold a position with the issuer such as employment, directorship, or consultancy

I and/or others I advise hold a material investment in the issuer's securities.

This is not investment advice. Please do your own research.